The Future of Payments in Saudi Arabia: How Paymes Meets Market Needs

Saudi Arabia’s payment landscape is transforming at remarkable speed. With contactless transactions now representing nearly two-thirds of all card payments, according to Visa Saudi Arabia, businesses face both opportunities and challenges in adapting to this new digital reality.

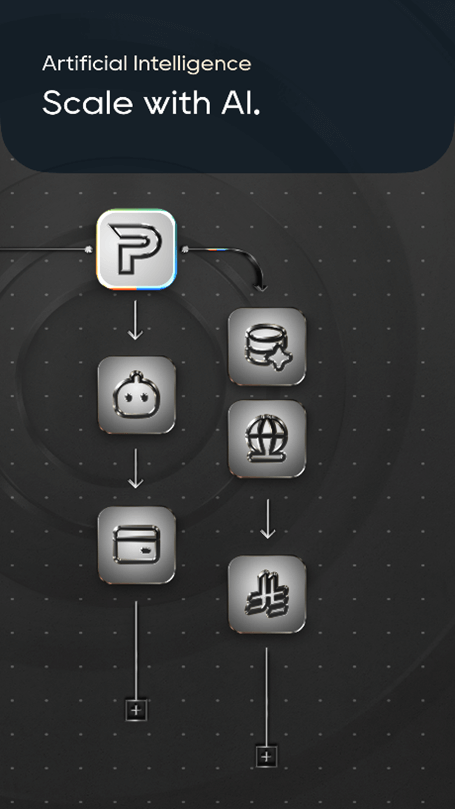

For Saudi entrepreneurs, this shift means rethinking traditional payment methods. The Paymes Super App enters this evolving market with solutions designed specifically for Saudi business needs – from bustling souks to ambitious online startups.

QR Payments Built for Saudi Commerce

Across the Kingdom, from the spice stalls of Jeddah’s Al-Balad to pop-up shops at Riyadh Season, QR code payments are becoming the new normal. The appeal is clear: no expensive hardware, simple setup, and compatibility with the smartphones nearly every Saudi customer carries.

Paymes takes this further by ensuring its QR system works seamlessly with Saudi payment preferences, including support for local payment methods and automatic VAT calculation – a crucial feature for businesses navigating KSA’s tax regulations.

PayLinks: The Social Commerce Advantage

With WhatsApp being the communication channel of choice for 89% of Saudi businesses, according to recent surveys, Paymes’ PayLinks feature taps directly into how Saudi entrepreneurs actually work. These versatile payment links can be shared anywhere – in WhatsApp chats, Instagram bios, or email signatures – turning every conversation into a potential sales opportunity.

For service-based businesses like fitness trainers, tutors, or beauty professionals, this means getting paid faster without awkward cash exchanges. Retailers can use them for pre-orders during peak seasons like Ramadan or Eid. The flexibility matches the dynamic nature of Saudi’s entrepreneurial spirit.

Looking Ahead

As Saudi Arabia continues its push toward a cashless society under Vision 2030, tools like these aren’t just convenient – they’re becoming essential for staying competitive. Paymes positions itself as a partner in this transition, offering payment solutions that grow with Saudi businesses.

Ready to streamline your business payments the smart way? Be the first to access Paymes’ Super App designed for Saudi businesses