10 Tips for Turning One-Time Shoppers into Loyal Customers and Help Boost Your Sales

Any business thrives on its loyal customers. Most big ecommerce brands attempt some kind of loyalty program that keeps people coming back. Nearly every B2B company has a small number of key accounts bringing in most of the revenue.

If you don’t have that stable of repeat buyers, you’re missing out. Not only do you lack that consistent source of revenue, but it might also suggest you’re not doing enough to earn those loyal customers.

Work from home platforms have changed the world and people are shopping online more than ever, too. This is a great time to be in ecommerce. With people more willing to buy online, customer acquisition costs should be falling. When you know how to turn those first-time buyers into brand evangelists, the opportunity is huge.

But how can you do that? Let’s go over ten tips you can use to turn first-time buyers into loyal customers.

Image source

Image source

What is customer loyalty?

We should make a distinction between “repeat buyers” and “loyal customers”. Repeat buyers will come back to you again and again when you announce new products or seasonal offers – you have their number and you don’t need to sell them hard on new campaigns.

Loyal customers are fully-engaged brand evangelists. They splashed out on a Peak Design backpack once and now they wouldn’t consider anyone else’s. They won’t buy a computer that doesn’t have an apple on it. In a B2B context, these would be the key accounts that the sales team knows on a first-name basis.

Not only are these the most financially valuable customers, but they’re also the core audience which the business should work to serve. What’s good for your most engaged customers, is good for the rest of them, and what’s good for them is good for the business. Listen closely to your most loyal customers, and you can’t go wrong.

You’d be lucky to turn even a small proportion of your customers into loyal customers. However, the benefit of trying to convert as many people as you can is that these loyal customers can become brand evangelists who’ll do your marketing for you. If they spend a lifetime recommending your product to everyone they talk to, your customer acquisition costs trend a little bit closer to zero.

With some simple incentives and easy-to-use referral tracking software, you can encourage and reward brand evangelists without the work of running a whole affiliate program.

How, though, do you inspire loyalty from one-time shoppers? Here’s ten top tips:

1. Use email

Most ecommerce companies are collecting customer emails to send receipts and to get in contact if something goes wrong in the shipping process. But how many of those companies are using that email to build a relationship with those customers?

Many companies don’t go beyond simple, transactional emails with titles like “Get 10% off now”. Consider how you could email more “brand marketing” content like short blogs or articles on the way you do things, and what makes you different from your competitors.

Think about what a dedicated email flow for that would look like – how you should introduce yourself to first-time buyers once they’ve ordered, and what you think they need to know about who you are. You can iterate and A/B test that flow until you get it exactly right, just like any other marketing effort.

You can also weave your brand story into those transactional emails. If you add a little bit of that messaging into your order confirmation email, customers will be seeing it every time they buy from you.

2. Create great experiences

People aren’t going to become loyal customers unless you provide a great experience. It’s why Apple put so much effort into their Apple Stores, from the staff who are paid to focus on educating customers rather than selling, to the cash registers and cables hidden inside the tables.

For an online store, creating a great experience means conducting a mobile usability test on all platforms like iOS, Android, etc. If you want to turn a first-time buyer into a loyal customer, you have to make sure everyone’s first impression of your site is flawless.

And it doesn’t stop there. When your customer gets their package delivered, make sure this is a great experience too. Sending your products in nice, branded packaging is just the start. Think about the whole experience.

Make sure you’re providing any helpful information the customer might need. Track the delivery and as soon as they receive it, send them an email or SMS with a friendly message and a link to useful pages on your site.

3. Offer discounts

Discounts are a tried and true tactic for boosting sales in ecommerce. It’s also very easy to personalize those discounts to specific customers. Every positive interaction a buyer has with your brand is an opportunity to turn them into a repeat customer, so you want to encourage as many of those interactions as possible.

4. Be proactive

Proactively following up with customers is a big part of customer care. If you wait until there’s a problem and the customer comes to you, then their only interactions with you will be when there’s something wrong. Over time, that builds up negative associations with you and your brand.

When your customer receives a tracked delivery, you could send them an email a few days later asking how the product is and if they have any comments or questions.

As well as building relationships with customers, this is a great way to gather data you can use to improve your product or service. More simply, it’s a great way to catch a product issue or computer bug that you might not notice in QA.

5. Exceed expectations

From internet service to energy providers, people are used to a poor level of customer service, especially over the phone. By exceeding expectations in every interaction, from your online store to customer service, you can surprise and delight users whether it’s via a customer support chat or in a virtual healthcare waiting room.

6. Use a loyalty program

A customer loyalty program won’t turn visitors into brand evangelists, but it can turn one-time buyers into repeat customers. That repeated exposure to your company gives you more opportunities to build up brand recognition and turn repeat buyers into loyal customers.

You can also use the loyalty program to offer a more personalized service. This could take the form of discounts on customers’ birthdays or other personalized offers based on their buying activity.

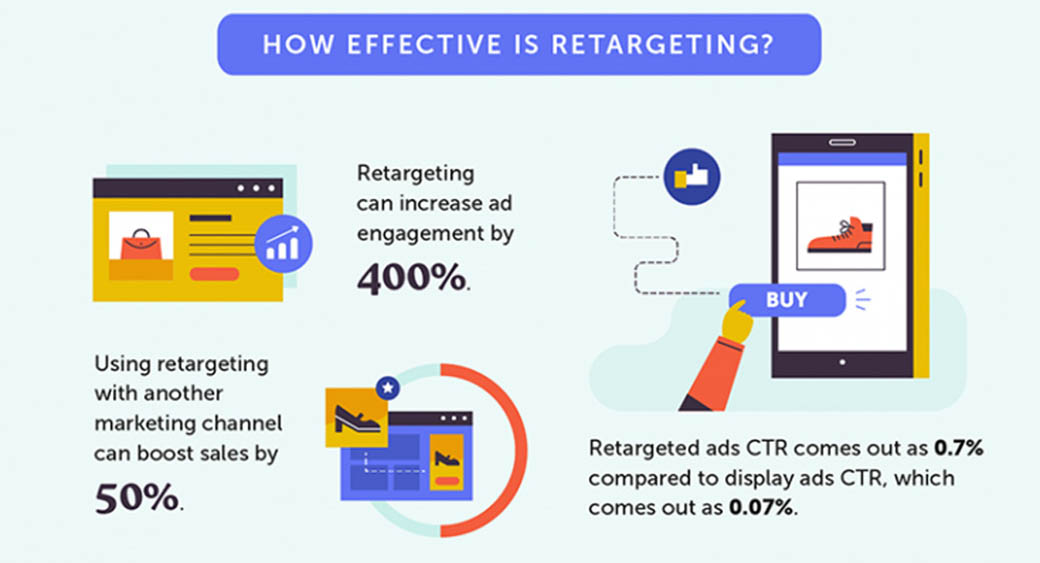

7. Use retargeting ads

Retail is a seasonal business, and for ecommerce stores, there’s a lot of value in turning seasonal buyers into repeat customers. Retargeted ads on social media can follow those users around Facebook and Instagram based on what they’ve done in your app, allowing you to get them back onto your site for a second or third time. Retargeting reduces the cart abandonment rate by 6.5% and can increase online sales by up to 20%.

8. Leverage seasonal marketing

When you do have a seasonal peak, one with an influx of new customers, it’s an opportunity to turn people into repeat customers. Seasonal marketing strategies like limited-time discounts and special offers for your loyalty program can help make repeat buyers of people who have bought from you before.

You can think of your first-time-buyer-to-loyal-customer pipeline like any other marketing funnel. Once you have your “bottom of the funnel” activities figured out, you can focus your seasonal marketing on attracting new first-time buyers knowing you’ll convert a number of them to repeat buyers in the future.

9. Use data

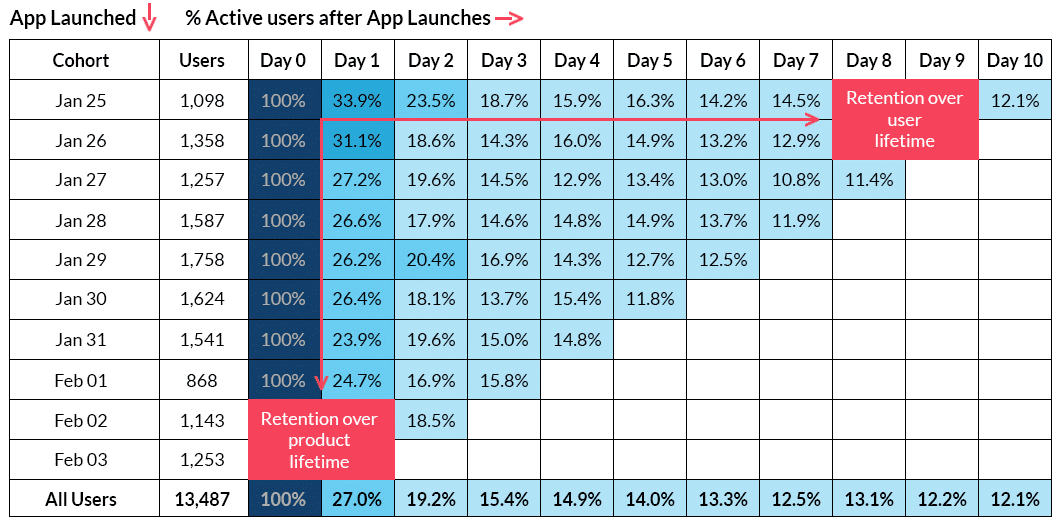

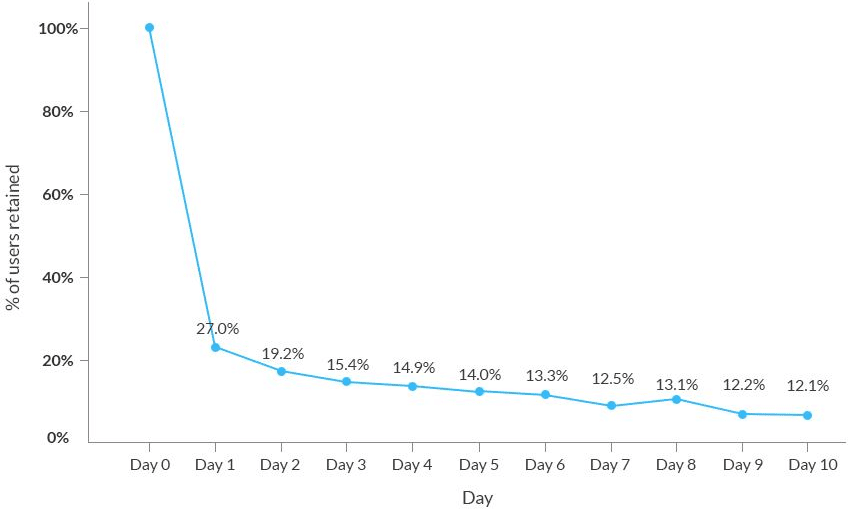

To turn your one-time buyers into loyal customers, you need to understand them. And you can’t understand your customers at scale without good data.

One of the reasons why a mobile app is a must have for small businesses is that you can collect more detailed data on the way customers interact with you.

Whether you’re an ecommerce giant or a small coffee chain collecting people’s favorite orders, even a relatively simple app can give you valuable data while improving the customer experience.

10. Make it personal

Personalization is one of the most powerful ways you can create memorable experiences for your customers, with 90% of consumers surveyed finding marketing personalization appealing.

One of the advantages of an ecommerce mobile app for your online store is that you can offer a high degree of personalization, from recommended products to push notifications on offers you know they’ll be interested in.

Personalized experiences could be as simple as recommending products you think they’d like. You can also use your marketing emails or mobile app notifications to send them offers you think they’d like at the time they’re most likely to buy.

Using the customer loyalty funnel to boost sales

With a combination of some of these ten tips, you can start to turn more of your one-time buyers into loyal customers. Just like any other marketing funnel you can learn from your successes, double down on what works, and use this knowledge to boost your sales in the long run.

Matthew Cooper – Marketing Automation & Operations Manager, Global App Testing

Matthew Cooper – Marketing Automation & Operations Manager, Global App TestingMatthew Cooper is the Marketing Automation & Operations Manager at Global App Testing, a best-in-class software testing company that has helped top apps such as Facebook, Google, Microsoft, and Craigslist deliver high-quality software at speed all over the world. Matthew has over 14 years of experience in the I.T Networking, Software & Services Industries. He is highly skilled in Search Engine Optimization (SEO), Content Marketing, Digital Advertising, Social Media Management, WordPress, Email Marketing, Marketing Automation, CRM, and People Management. You can find him on LinkedIn. He has also written content for DZone and BigCommerce.

Jessica Day – Senior Director, Marketing Strategy, Dialpad

Jessica Day – Senior Director, Marketing Strategy, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad