PayTabs Group Strengthens Indo-Saudi Fintech Collaboration

As India celebrates its Independence Day, the nation’s digital economy continues to thrive, supported by global fintech partnerships. Among them, PayTabs Group, a leading payment orchestration provider, plays a pivotal role in advancing financial connectivity between India and Saudi Arabia.

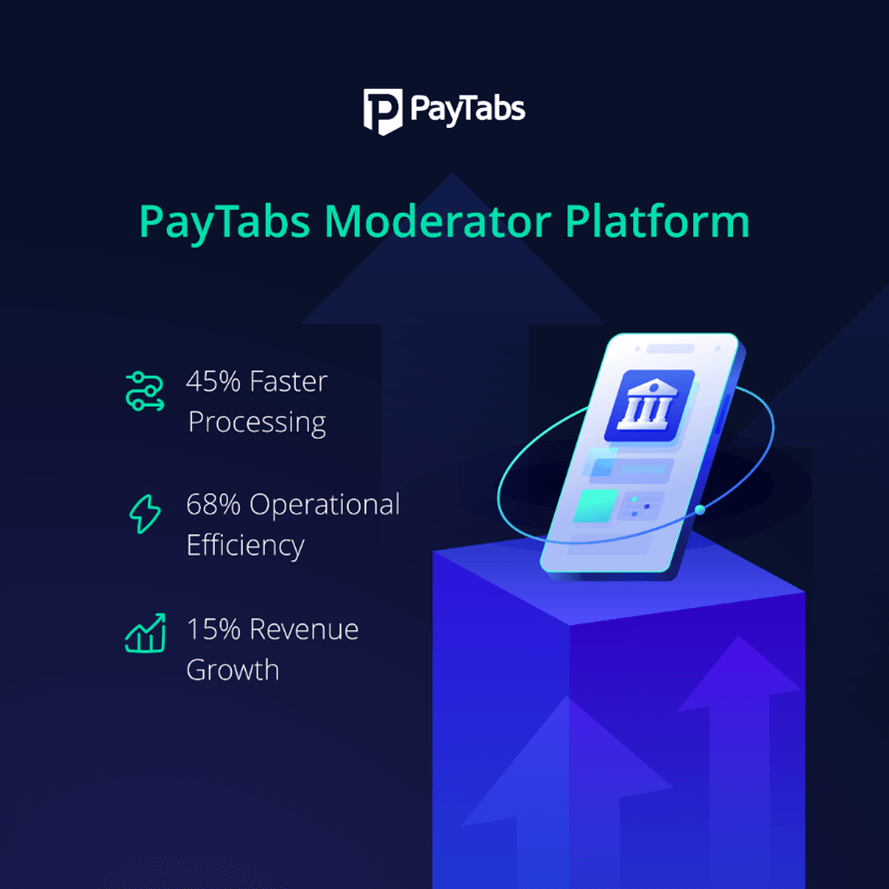

With a strong presence in India’s fast-growing digital payments sector, PayTabs has become a key enabler of secure and scalable transactions. Through AI-driven payment orchestration and white-label solutions, the company supports businesses and government initiatives across the region.

A Strategic Fintech Partnership Between India & Saudi Arabia

PayTabs’ expansion in India highlights the deepening economic collaboration between the two nations. Since acquiring Chennai-based OGS Pay and establishing local operations, PayTabs has:

✔ Delivered regulatory-compliant payment solutions tailored for Indian businesses.

✔ Enhanced digital commerce with secure, locally hosted payment technology.

✔ Promoted financial inclusion through advanced payment orchestration.

Why India is a Key Market for PayTabs

India’s digital economy is on track to reach $1 trillion by 2030, making it a priority for fintech innovation. PayTabs is committed to supporting this growth by:

🔹 Providing AI-powered transaction processing for seamless digital payments.

🔹 Offering white-label payment solutions for enterprises and financial institutions.

🔹 Enabling unified payment platforms for large-scale digital commerce.

With ongoing collaborations with regulators and financial partners, PayTabs is helping shape India’s cashless future.

Celebrating India’s Progress with PayTabs

This Indian Independence Day, we recognize the nation’s digital achievements and the role of fintech in driving economic growth. As a top fintech company, PayTabs remains dedicated to:

✅ Strengthening cross-border digital payments between India and Saudi Arabia.

✅ Delivering secure, scalable fintech solutions for businesses.

✅ Advancing AI and white-label innovations for a smarter financial ecosystem.

Explore how PayTabs is transforming payments: PayTabs Payment Orchestration Platform

PayTabs Group’s growing role in India underscores the power of Indo-Saudi fintech collaboration. With AI, white labelling, and payment orchestration, the company is helping build a more connected and efficient digital economy.

This Indian Independence Day, we celebrate progress and look forward to a future of innovation and financial empowerment.

#IndianIndependenceDay #FintechInnovation #PaymentOrchestration #PayTabs #DigitalIndia #IndoSaudiCollaboration